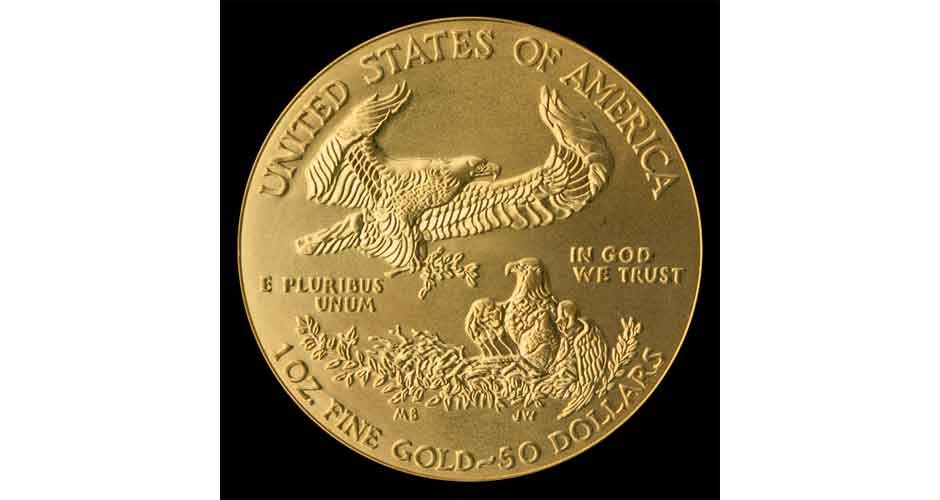

Gold Eagles, produced by the United States Mint, are highly esteemed coins regarded by investors as valuable and reliable assets.

With a long, steady history of stability and intrinsic value, they have proven over time to be part of a smart investment strategy.

In this article, we will delve into a few of the reasons that Gold Eagle coins are considered a prudent investment option and why so many people are adding them to their portfolios.

They are a tangible asset.

One of the main benefits of investing in Gold Eagles is their physical nature. Unlike stocks or digital investments, these coins offer investors a tangible and portable form of wealth that they can keep in their possession.

Their durability, divisibility, and universal recognition make them a convenient method of exchange during economic downtimes. This tangibility creates confidence and helps to preserve your wealth in times of financial volatility.

They hold intrinsic value.

Gold Eagle coins are made of 22-karat gold, which gives them intrinsic value that transcends market fluctuations. Precious metals, such as gold, have long been seen as stores of value and are sought after for their unique properties and scarcity.

As a limited resource, gold maintains its value and acts as a buffer against currency devaluation and inflation. The enduring allure of gold continues its desirability, making Gold Eagles a solid investment choice.

They offer liquidity.

Gold Eagles are highly liquid assets, frequently bought and sold on both US and foreign markets. The United States Mint guarantees their authenticity, purity, and weight, which increases their marketability.

They are widely recognized and accepted, making it quick and simple for owners to convert their coins into currency whenever they prefer. This liquidity provides financial flexibility and ensures that investors can quickly react to changing economic conditions or personal circumstances.

They offer portfolio diversification.

A well-balanced portfolio should also include certain risk mitigation. Diversifying with gold coins is an effective way to do exactly that. Gold’s historically inverse relation to the stock market makes it an enticing option for insulating against market uncertainty. By including these coins in a diversified holding, you can increase your stability and potentially reduce losses during turbulent economic times.

They provide a store of wealth.

Throughout history, gold has held its value and acted as a reliable store of wealth. Gold Eagle coins have the advantage of being recognized internationally, allowing investors to preserve their wealth across borders.

They provide stability and security that paper and digital investments simply cannot. During times of political instability and/or economic turmoil, gold has proven its ability to protect purchasing power and wealth.

The Gold Eagle coin has been and remains a solid investment.

Gold Eagles offer numerous benefits and advantages for people seeking a sound investment option. Their tangibility, intrinsic value, liquidity, diversification potential, and historical stability make them a highly attractive draw for those looking to grow and protect their wealth.

Including these coins in a well-balanced investment portfolio can provide peace of mind in the present while offering the potential for financial gain in the future.